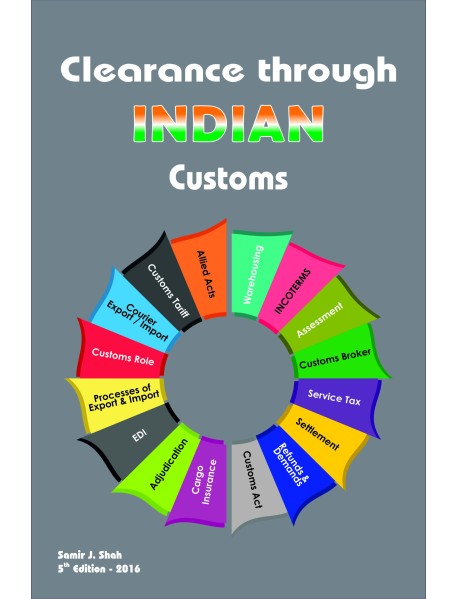

Clearance through Indian Customs for CBLR

Clearance through Indian Customs for CBLR

- Brand : JBS ACADEMY PVT. LTD.

- Product Code : VBH000384

- Availability : 46

-

Rs900.00

- Ex Tax :Rs900.00

This book will find useful information and knowledge to the readers about the working of Customs in India. The contents are a faithful interpretation of Customs law and procedures as author Mr. Samir J Shah has understood in many years of working as a Customs Broker at various ports of the country and also at various ICD’s of the country.

The Author feels fortunate to have worked under both economic regimes of the independent India. With liberalization and opening of many inland Customs clearance centers came in new licensing regulations for Customs House Agents. It opened the doors for many to participate in this segment. These new centers thrived on growth and not on domain knowledge. This was neither a sustainable way of undertaking customs clearance nor desirable from revenue and security view points of the government. Availability of very little literature on this created a curiosity in Mr. Samir J Shah to document it and made a ready reckoner for colleagues and friends engaged in the industry.

This book covers

• Basic background of Customs Act

• Role of customs

• Incoterms

• Value for customs

• Customs tariff

• Customs Act

• Prohibitions

• Allied acts and their applications under the provisions of customs act, 1962

• Control over conveyances

• The clearance processes in a nutshell

• The process of import clearance

• Assessment of import goods

• Import / export through courier

• Clearance for in-to bond (warehousing)

• Exports

• Drawback on exports

• Transhipment

• Baggage

• ICD – CFS

• EOU / STP / EHTP / BTP Scheme

• About documentation

• Refunds & demands

• Adjudication

• Settlement commission

• Appeals

• Customs broker licensing

• Electronic data interchange E.D.I

• Containerisation

• Custodians of goods under customs control

• Service tax

• Packaging

• Customs Act & its Co–relationship

• Summary of important provisions of The Customs Act, 1962

• Self assessment in Customs, RMS and OSPCA