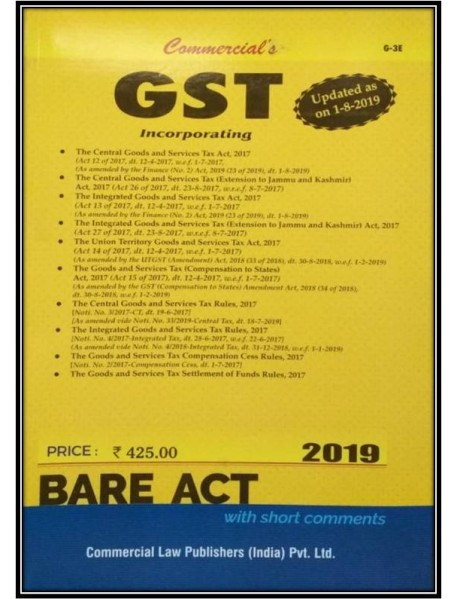

GST BARE ACT

GST BARE ACT

- Brand : Commercial Law Publishers

- Product Code : VBH000117

- Availability : 50

-

Rs425.00

- Ex Tax :Rs425.00

G-3E

(Updated ason 1-8-2019)

Incorporating

The Central Goods and Services Tax Act, 2017

(Act 12 of 2017, dt. 12-4-2017, wef. 1-7-2017,

(As amended by the Finance (No. 2) Act, 2019 (23 of 2019), dt. 1-8-2019)

The Central Goods and Services Tax (Extension to Jammu and Kashmir)

Act, 2017 (Act 26 of 2017, dt. 23-8-2017, w.r.e.f 8-7-2017)

The Integrated Goods and Services Tax Act, 2017

(Act 13 of 2017, dt. 12-4-2017, w.e.f. 1-7-2017

(As amended by the Finance (No. 2) Act, 2019 (23 of 2019), dt. 1-8-2019)

The Integrated Goods and Services Tax (Extension to Jammu and Kashmir) Act, 2017

(Act 27 of 2017. dt. 23-8-2017, w...f 8-7-2017)

The Union Territory Goods and Services Tax Act, 2017

(Act 14 of 2017, dt. 12-4-2017, w.e.f. 1-7-2017)

(As Amended by the UTGST (Amendment) Act, 2018 (33 of 2018), dt. 30-8-2018, tee.f. 1-2-2019)

The Goods and Services Tax (Compensation to States) Act, 2017 (Act 15 of 2017), dt. 12-4-2017, w.e.f. 1-7-2017)

(As amended by the GST (Compensation to States) Amendment Act, 2018 (34 of 2018)

dt. 30-8-2018, w.e.f. 1-2-2019)

The Central Goods and Services Tax Rules, 2017

[Noti. No. 3/2017-CT, dt. 19-6-2017]

(As amended vide Noti, No. 33/2019-Central Tax, dt. 18-7-2019]

The Integrated Goods and Services Tax Rules, 2017

[Noti. No. 4/2017 Integrated Tax, dt. 28-6-2017, w.e.f. 22-6-2017]

(As amended vide Noti, No. 4/2018-Integrated Tax, dt. 31-12-2018,w.e.f. 1-1-2019)

The Goods and Services Tax Compensation Cess Rules, 2017

Noti. No. 2/2017-Compensation Cess, dt. 1-7-2017)

The Goods and Services Tax Settlement of Funds Rules, 2017