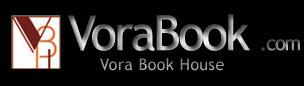

GST READY RECKONER 24TH EDITION SEPTEMBER 2024 PUBLISHED BY TAXMANN PUBLICATION

GST READY RECKONER 24TH EDITION SEPTEMBER 2024 PUBLISHED BY TAXMANN PUBLICATION

- Brand : Taxmann

- Product Code : VBH000310030

- Availability : 50

-

Rs2,495.00

- Ex Tax :Rs2,495.00

GST READY RECKONER 24TH EDITION SEPTEMBER 2024 PUBLISHED BY TAXMANN PUBLICATION

Taxmann's 'GST Ready Reckoner' is a widely acclaimed, comprehensive guide that provides a thorough and systematic understanding of all aspects of GST laws in India. The book is meticulously organised into 55 chapters, providing precise and detailed explanations on essential topics such as supply, valuation, input tax credit, sector-specific provisions, and procedural aspects, supported by relevant case laws, notifications, and circulars.

As part of Taxmann's renowned series of bestsellers on GST laws, this ready reckoner emphasises accuracy and reliability, adhering to a Six Sigma approach to achieve 'zero error.' This makes it helpful for professionals, legal advisors, businesses, and tax officers who require up-to-date, precise information on GST. The user-friendly structure and comprehensive coverage ensure that complex GST provisions are distilled into accessible, practical insights, facilitating effective understanding and application of the law.

The Present Publication is the 24th Edition | September 2024 and has been amended by the Finance (No. 2) Act, 2024. It covers the recommendations of the 54th GST Council Meeting held on 09-09-2024 and is authored by Mr V.S. Datey, with the following noteworthy features:

- [Comprehensive Coverage Across 55 Chapters] The book discusses all essential provisions of the GST framework, systematically divided into 55 chapters. It covers foundational concepts and extends to specific and advanced topics, including:

- Foundational Topics – Introduction to GST, its various components (IGST, CGST, SGST, UTGST), and the core taxable events

- Detailed Analysis of Supply – Covers supply of goods and services, classification, valuation rules, and special scenarios when the value for GST is not ascertainable

- Input Tax Credit (ITC) – Thorough guidance on ITC eligibility, distribution, conditions, and issues, including specific chapters on handling ITC when both exempted and taxable supplies are made

- Sector-Specific Provisions – Detailed chapters on real estate (including TDR/FSI), distributive trade, passenger and goods transport, financial services, leasing, software, telecommunication, and other business services

- Procedural Aspects – Comprehensive sections on registration, invoicing, e-way bills, tax payments, filing returns, and compliance with audit and assessment procedures

- Legal Framework – Extensive coverage of legal provisions regarding appeals, offences, penalties, prosecution, and compounding, along with practical guidance on handling these aspects

- Special Topics and Updates – Includes additional chapters on e-commerce, GST compensation cess, transitory provisions, and a detailed constitutional background of GST

- [Bestseller Recognition] As part of Taxmann's highly trusted and bestselling series on GST laws, the 'GST Ready Reckoner' has established itself as a go-to resource for indirect tax professionals, earning a reputation for accuracy, reliability, and comprehensive coverage

- [Six-Sigma Approach] Adhering to the Six-Sigma quality standard, the book aims to achieve 'zero error' in content, ensuring that users can rely on the accuracy of the information provided. This benchmark of excellence underlines the book's commitment to delivering a flawless reference experience

- [Practical Utility and Easy Reference] Featuring a user-friendly layout with clear headings, tables, and summaries, the 'GST Ready Reckoner' is structured to provide quick answers and practical guidance on day-to-day GST queries. Its clear presentation and logical arrangement of topics make it helpful to locate precise and actionable information

- [Sector-Specific Guidance and Unique Insights] Special attention is given to unique provisions like TDR/FSI in real estate, works contract services, financial and related services, and the treatment of goods and passenger transport. This detailed focus allows users to gain a nuanced understanding of how GST applies across different sectors